ux/ui case study: Blank Financial

Redesigning the complete UX/UI for a Melbourne based multi-award mortgage specialist

overview

Blank Financial is a multi-awarded mortgage broker based in Melbourne, Victoria. They believe in providing opportunities to their clients, whether it’s buying their dream home or unit apartment. They help their clients repay on a smarter way, which ultimately saves them money over the course of their life.

Their previous website had not been updated in a long time and didn’t meet the company’s and its customers’ needs.

outcome

We recently redesigned their website to provide even better service to their clients. We have added mortgage calculators, which make it easy for customers to calculate their mortgage payments and determine their affordability. Additionally, we have added a chatbot feature for easy contact, which allows customers to ask questions and get quick responses in real-time. These updates to the website make it easier than ever for customers to access the services and information they need from Blank Financial.

Role

UX/UI Designer

tools

Figma, WordPress, Elementor & Adobe Creative Suite

WEBSITE

the process

Redesigning with emphasis on solutions, not jargon

research summary

In order to find what the main issues facing users were, I conducted research by talking to existing users and going through online reviews.

I created a user persona based on my research, and found that this user wants to have all features available to them in one website. The new site needs to be simple and easy to read and find things. This means that the user wants to be able to access all of the features of the product or service without having to go through any hoops or steps. For example, if the user is looking for a way to calculate the payment of a mortgage, they want to be able to find all of the information they need on one website, without having to go to multiple websites or call multiple people. This user is also likely to be impatient, so they want to be able to find what they are looking for quickly and easily.

research results

pain points

Jargon and

Outdated Design

The website wasn't functional, full of meaningless words and images.

One Page Website

The site was an outdated "one page" website, without much relevant information and zero functionality.

Useless UX/UI

The site was created thinking on the client, not the user.

THE PROBLEM

Most of clients found them by word of mouth or recommendations. However, their one-page website was outdated, and the UX/UI across platforms was poor, making it difficult for new clients to contact them and to support new business flows that developed over the years in the industry.

INSIGHTS

The information presented and ways of contact were not easily comprehensible to certain users, leading to a misinterpretation of the information.

With the increase in competition entering the market, our client realized the importance of enhancing their digital experience. Therefore, they looked for a design team to provide end-to-end UI/UX redesign to meet the evolving industry standards and cater to a broader audience. I was in charge of this project myself.

OBJECTIVES

We embarked on a quest to revolutionize the online experience for Blank customers by crafting a web design that puts them at the center. Our mission was clear:

- Introduce an innovative, user-friendly website design with compelling messaging that resonates with our customers

- Develop a mobile-first approach for a seamless browsing experience across all devices

- Deploy a savvy chatbot to ensure rapid resolution of customer inquiries

- Provide complimentary access to powerful financial tools such as calculators and real-time credit valuations.

persona:

After defining the scope of the website, the next step was creating a persona to better understand our users’ goals.

Laura Thomson

Laura, The decision maker

Age: 37

Occupation: Marketing Manager

Melbourne, VIC.

"I'm looking for a house to buy. I'm currently renting an unit in the city with my partner. We're looking for a house that is in a safe neighborhood, close to work and amenities, and has enough space for us to grow a family. We're also open to renovating if the price is right. We need a mortgage broker to get the best rate possible."

Goals

- Find a 2 or 3 bedroom house, close to the city of Melbourne

- Find a mortgage with competitive rates and terms

- Find a trusty mortgage broker that understand my needs and budget

Pain Points

- Too many options, everyone claiming to be the best in business

- Wants to ensure that she is getting the best mortgage rates and terms

- Needs personalised support and guidance throughout the process

Behaviours

- Researches online before making any decisions

- Prefers independent brokers

- Values personalised service

User Flow

I created a simple user flow diagram to map out these features and see what kind of pages would be necessary for the app.

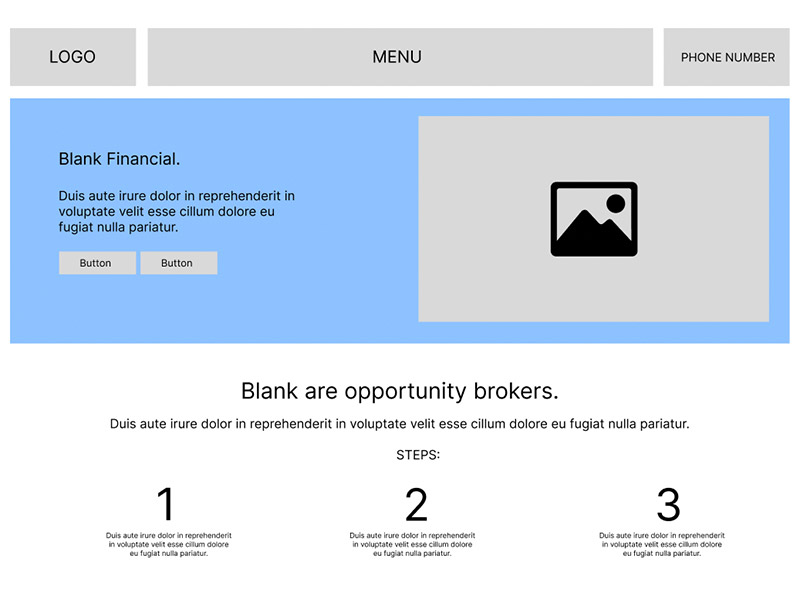

LO/MID DESIGNS

Once I completed the initial research, creating personas to understand the user's context of use, their behaviors and frustrations and determined the optimal structure for the website, we were able to start visualizing my ideas and producing wireframes.

UX/UI

Then, I designed the UI on WordPress, where I put together different ideas for how our website could look and made some detailed designs.

Finally, I spent a couple of days making the site fully functional with online calculators and a live chatbot.

Design System

New colours, fonts and style for this renovated award winning mortgage broker.

The final product

Rather than simply improving the website, my aim was to enhance the online experience for users in Victoria by providing them with access to valuable, free financial content.

By actively listening to the needs and desires of their customers, I was able to create a responsive website that instilled confidence in its users.

Additionally, I streamlined the process by including links to our online real-time loan calculators and online credit checker and chatbot, ensuring a seamless and efficient experience.

- Figma

- Adobe Photoshop

- CSS/HTML

- WordPress

- Google Analytics

- Elementor